Business Articles - Money Management

Articles & Tips

If you like to customize, stick with Pro; if you prefer prebuilt templates and reports, consider Contractor

by Melanie Hodgdon

As a certified QuickBooks advisor, I am asked by a lot of contractors who are already using QuickBooks Pro ($300 retail) whether upgrading to the Premier Contractor Edition ($500) makes sense for them. The answer, not surprisingly, depends on who's asking the question.

What's Different About Premier

QuickBooks Premier for Contractors attempts to provide a complete setup — including

a Chart of Accounts, an Items List, and a Class List — that allows the user

to avoid many of the decisions that would have to be made setting up QuickBooks

Pro. It also contains a Contractor-specific menu of tasks such as estimating,

invoicing, entering bills, and paying employees, and a special Contractor menu

of job-related reports that are easy to access by a novice user. Because it's

based on the Premier version of QuickBooks (a more powerful version, just as

Pro is more powerful than Basic), it boasts some extra bells and whistles. How

relevant they are to your needs is questionable (see "QuickBooks Contractor Business

Tools," below).

QuickBooks Contractor Business Tools The Premier version provides analytical business

tools not found in Pro: |

QuickBooks Pro offers an open-ended structure that requires the user to fill in what he wants for himself. You can get it to give you virtually everything you want for your company, but it takes work and a high level of understanding of the software.

Which product works best for you depends on several factors: whether you are already using the Pro version; your accounting expertise; and the extent to which you wish to customize the file.

Is Pro working for you? If you're already using the Pro version and it's working, much of the initial advantage of the Contractor edition will be lost to you. Assuming that you elect to keep your existing company file, you will simply upgrade your current software to the Premier version. Because your file already contains the Chart of Accounts, the Items List, and possibly the Class List, you will bypass getting to use what Intuit has set up for you in the Contractor's edition. Once you upgrade your existing file, it will look precisely like Pro, with the exception of the special Contractor activities and reports menus, which you may find convenient. Therefore, only users willing to start a brand-new file will reap the benefits of the pre-existing setup.

Bear in mind, too, that virtually all the Contractor activities in the Premier Contractor edition are located in Pro's Customer, Vendor, and Employee menus, and all the reports listed in the Premier Contractor edition's Contractor Reports menu are also available through Pro, although you need to know more about the software to access or create them.

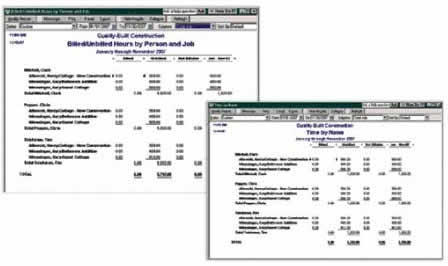

For example, in Premier for Contractors you will see the following report under

the Contractor Reports menu: Billed/Unbilled Hours by Person and Job (see Figure

1). This report shows hours worked on jobs during a designated time period, sorted

by employee. The exact same report is available in QuickBooks Pro if you use

the standard Jobs & Time report called Time by Name and customize it by placing

check marks in the options Billed, Unbilled, and Not Billable. Once memorized,

this report could be available to you in Pro by whatever name you wish.

Figure 1. This pre-existing report (left)

in Premier Contractor's version shows billed, unbilled, and not billed costs

for various jobs, sorted by employee. A modified report from QuickBooks Pro (right)

shows the same information; the report can be renamed and saved for ready access.

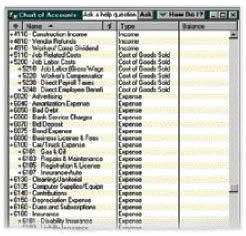

Premier Chart of Accounts better. On the other hand, if your accounting background

is limited and you're coming to QuickBooks as a first-time user, you will certainly

avoid some common errors if you use Premier Contractor's preset Chart of Accounts

(Figure 2).

Figure 2. Premier for Contractor's preset Chart of Accounts

will give a good start to users with no background in accounting. Pro's "Construction" Chart

of Accounts, by contrast, mixes up some direct and indirect costs.

Pro's "Construction" Chart of Accounts is woefully poor, and actually mixes together job-related and overhead costs. For instance, your customary job-related costs would include labor, materials, subs, and perhaps a fourth catch-all category for equipment rental and other miscellaneous direct job costs. All of these job-related costs should be "above the line" in

the category of accounts called Cost of Goods Sold. That would relegate your

truck loan interest, office supplies, and accounting costs to overhead, in accounts

categorized as Expense. In Pro, however, you won't find any accounts assigned

to Cost of Goods Sold categories, and you'll find Subcontractors and Job Materials

set up as Expense accounts and treated the same as office supplies and postage.

While easy to correct, users with a limited understanding of accounting may hesitate

to make the necessary changes.

Matching the Way You Work

If you truly love customizing to get things just the way you want them, you may

find that it takes the same amount of effort to change the pre-existing setup

for Premier Contractor as it takes to create your own in Pro. The benefit of

having a pre-existing setup that conforms to somebody else's perception of what

works depends on how closely that perception matches your own.

It's a lot like estimating software. Many contractors happily put their faith in an estimating package and, after confirming its accuracy, use it year after year. They're willing to excuse its idiosyncrasies or inefficiencies in the name of expediency. Others have long lines of estimating packages sitting on their shelves and have settled on a custom-designed spreadsheet because it feels comfortable, thinks the way they do, and spits out paperwork in a format that appeals to them. Nobody thinks through a job exactly the same way, and some contractors are unwilling to conform to a system that's a mismatch for the way they think. Therefore, if Intuit's idea of how to track information about your business mirrors yours, you'll probably feel comfortable with it.

The preset Items List in Contractor looks a lot like the HomeTech phases, but

has some idiosyncrasies, such as single sub-items and a list of items for developers

(Figure 3). If you don't like what you see, you can always change things to

suit you, but that may negate the advantage of purchasing the more expensive

software.

Figure 3. Premier Contractor's preset Items list is similar to the phase list

in HomeTech's estimating program. The list can be modified to suit the user,

but given the extra cost for Premier, extensive customization would be better

done in Pro.

Job-cost reports depend on a blend of Items and Classes in the Contractor version.

For every job-related transaction you enter, you must enter the phase by Item,

and the kind of charge (labor, materials, subs, equipment rental, and so forth)

by Class. The Class List comes preset for you, which means that when you run

a job-cost report of Estimated vs. Actual costs for a given job, you will get

a "lump" of costs for each phase until you ask for the details by running the

report by Class also (Figure 4). This will give you an analysis for labor, materials,

subs, and equipment, but in a wide layout with many columns that I find visually

confusing. If you're accustomed to breaking out your labor, material, and sub

costs through your Items and using Class tracking for another purpose (such as

categorizing the kind of job, customer, or location), then this may feel cumbersome

to you.

Figure 4. The preset Classes (top left)

in QuickBooks Contractor allow you to expand the lump-sum totals in a job-cost

report (tracked by Item alone, top right) into a breakdown by revenue and cost

categories (bottom left). However, the report is complex and not particularly

useful.

Bear in mind that you can run a P&L by Class, so if you're interested in running a P&L

that will compare your profitability for remodeling vs. new construction, or

kitchens vs. baths, or residential vs. commercial, or some other breakdown of

sales, then it does not make sense to use Classes the way Contractor wants you

to when identical information can be achieved via Items.

Bells and Whistles?

New features in Premier for Contractors — like the ability to "automatically

create change orders, invoices, and purchase orders from estimates" — sound

very exciting. In actuality, the change-order option is a bit clunky.

Let's say you go into the original estimate, which has a line item for Plans

at $100 with a markup of 60 percent, showing on the printed estimate as $160.

If you alter the cost for Plans to $200, QuickBooks will automatically apply

the 60 percent markup. Now your line-item charge-out price (what the customer

will see) has increased to $320, a change of $160. When you save the revised

estimate, you will get an option screen (Figure 5) that invites you to let QuickBooks

add the change order. Any time you edit the cost of an item with a markup, the

Intuit-supplied message will be confusing. The canned comment will read, "Increased unit cost of 01.1 Plans from $100 to $200. (+$160.00) Net change to estimate +$160.00." This

sticks your markup right under your customer's nose while simultaneously confusing

him. Does the change cost $100 or $160? If $160, why mention $100? (It should

be noted that if you are estimating an Item for which there is no markup, this

is not a problem.)

Figure 5. The change-order function in

QuickBooks Contractor adds a note to the revised estimate (top). Note that if

you mark up change orders, you will reveal your markup to the customer on the

QuickBooks-generated statement (bottom) unless you delete or edit the note. The

author prefers to enter change orders manually so the additional amount becomes

a separate line item, allowing the builder to invoice for it separately.

If you are using the "automatic change order" option to save time and don't mind if your customer sees what QuickBooks arbitrarily adds, you're okay. If you prefer to bury your markup, then this option may not work for you unless you go in and edit the text yourself. But how convenient is this "time-saving" feature

if you have to edit the result every time?

Customizing With QuickBooks Pro

This software has been around for over a decade and is designed to be ultraflexible

to meet the needs of virtually any business. I have used it for contractors,

fishing fleets, retail stores, restaurants, bed-and-breakfasts, a used-car business,

and a dental office. Its strength lies in its flexibility. I like to compare

it to building a custom home rather than moving into a prebuilt one.

In the setup process, Pro offers you a choice of industry-specific Charts of Accounts (construction, farming, advertising, manufacturing, and so on). If you pick construction from the list, you'll be sharing about 75 percent of the same accounts as the other choices would produce. You build your own Items List from scratch, and if you use Classes it's because you decide you want to track something of specific interest to you.

As with a custom home, you will ideally wind up with something of high quality that has been specifically designed to meet your practical and aesthetic needs. But, as with construction, the greater the number of important decisions you're asked to make, the greater the danger of making mistakes. Fortunately, unlike a construction project, setup errors in QuickBooks are generally easy to correct.

Although suitable for virtually any kind of company, QuickBooks Pro has also

incorporated a number of specifically builder-friendly features. They include

the ability to set up Jobs under customer names, a designated set of Job reports,

and the capacity to easily invoice for time and materials as well as for contract/fixed-price

jobs using a variety of invoicing options, including progress payments. Functionally,

Pro will do virtually anything that the Premier Contractor edition will do for

day-to-day accounting. It doesn't have some of the "higher functions" that Premier

provides; if these functions are important to you, then Pro won't give you what

you need.

Glossary of QuickBooks Terms

Chart of Accounts. A listing of your general ledger accounts. Includes

those accounts associated with your Profit & Loss Statement (such

as income, cost of goods sold, and expenses) and with your Balance

Sheet (assets, liabilities, and equity). All transactions eventually

affect your Chart of Accounts and contribute to your financial reports.

When your accountant asks you for reports on which to do your taxes,

he or she will be looking at the dollar values of these accounts. |

Bottom Line

I always tell clients that in order to produce a workable QuickBooks company

file and use it properly, they need to know three things: accounting, their specific

business needs, and the software itself.

Accounting. The Premier for Contractor version will help you with accounting, though you may still need assistance from an accountant or other qualified resource. Pro's Chart of Accounts for contractors mingles job-related and overhead costs, which is just plain wrong. It provides fewer accounts in its Chart of Accounts than the Premier Contractor edition does, so you'll probably need to add more. If your accounting isn't strong, this could present a problem: The more accounts you need to add, the more errors you may make. Luckily, either version allows you to modify your Chart of Accounts with ease, and you should plan on having to add and remove accounts from either program to suit your company's needs.

Specific business needs. Premier for Contractor

purports to understand your needs. If its preconceived notion of how you run

your business is spot on, you're in great shape. If you have a different approach,

then the amount of customizing you'll need to do may negate the advantage of

buying a canned setup. Pro can give you virtually identical flexibility, but

you'll have to start from scratch to generate some of the reports that Contractor

will give you out of the box. If you use some of the "higher function" tools

that the Premier version offers, then that's a significant advantage.

The software. The two programs work in a similar manner, except for the potential difference of using Classes in the Contractor version in a predetermined way. Your learning curve will be about the same for each, the exception being that Contractor users have readier access to more job-related reports through the Contractor Reports menu. While similar information is available in Pro, you'll have to understand the program better to get at it. There is no difference in the time required to enter data or generate reports; users deciding to upgrade won't notice any visible change, so no additional training will be required.

There is probably a greater incentive for non-QuickBooks users to begin with the Contractor edition. Benefits to established users will come primarily from the more powerful functions available from the Premier version and possibly from ready access to reports that they may not have already discovered on their own.

Melanie Hodgdon is a business systems consultant for builders in Bristol, Maine.

This article has been provided by www.jlconline.com. JLC-Online is produced by the editors and publishers of The Journal of Light Construction, a monthly magazine serving residential and light-commercial builders, remodelers, designers, and other trade professionals.

Join our Network

Connect with customers looking to do your most profitable projects in the areas you like to work.